The US economy entered 2024 on solid balance, yet headwinds including increasing shopper obligation and raised loan costs will burden financial development. While we don't estimate a downturn in 2024, we truly do expect purchaser spending development to cool and for generally Gross domestic product development to ease back to under 1% over Q2 and Q3 2024.

From that point, expansion and loan fees ought to bit by bit standardize and quarterly annualized Gross domestic product development ought to meet toward its capability of close 2% in 2025.

US customer spending held up astoundingly well in 2023 regardless of raised expansion and higher loan costs. In any case, this pattern is as of now mellowing in mid 2024. For example, retails deals development over the initial not many months of the year have been feeble.

Gains in genuine expendable individual pay development are relaxing, pandemic reserve funds are lessening, and family obligation is expanding. Customers are spending a greater amount of their pay to support obligation and misconducts are rising. Moreover, the development in 'purchase presently, pay later' plans may likewise burden future spending as bills come due.

Hence, we estimate that general shopper spending development will slow in Q2 and Q3 2024 as families battle to track down another harmony between pay, obligation, reserve funds, and spending.

While we expect work economic situations to relax over this period, we don't anticipate that they should fall apart. As expansion and financing costs decrease, utilization ought to grow by and by in late 2024.

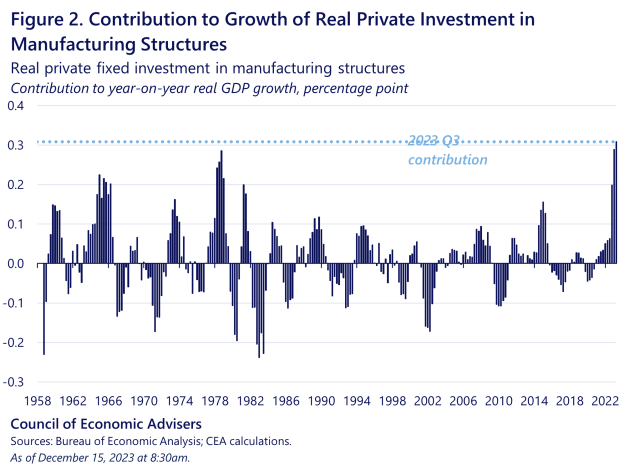

Following a pop in mid 2023, business speculation development eased back in H2 2023 as loan fee increments made supporting exercises more costly. This pattern ought to strengthen in H1 2024 as the Fed opposes calls to cut loan costs likely until June 2024.

Private venture, which had been contracting beginning around 2021, started to fill again in Q3 2023. Steady interest for homes and a lack of supply was the driver. Nonetheless, looking forward, we don't anticipate that private venture development should reasonably improve until loan fees start to fall.

Government spending was a positive supporter of monetary development in 2023 because of bureaucratic non-protection spending related with foundation speculation regulation passed in 2021 and 2022.

This tailwind has not decreased and spending on these projects will keep on supporting Gross domestic product development. Notwithstanding, political instability encompassing monetary arrangement, obligation, and costs could influence government spending throughout the following couple of years.

Work market snugness remains amazingly relentless. This pattern is supported by the retirement of the Person born after WW2 age and the hesitance of organizations to lay off laborers. While we in all actuality do expect some conditioning in the work market as the economy eases back, we don't anticipate that it should disentangle.

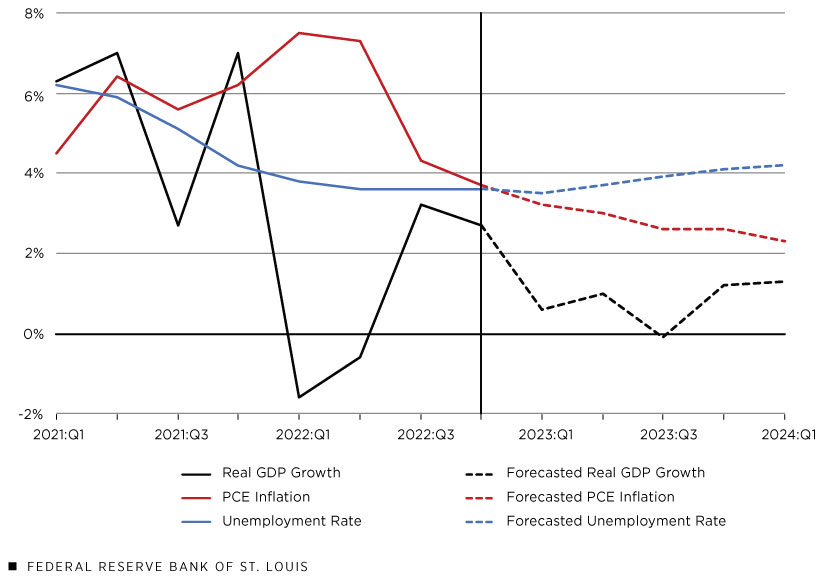

On expansion, much headway was made throughout the span of 2023 yet later information show that force has eased back. Arising patterns in energy markets and among specific administrations enterprises are filling in as a headwind, however support from cooling rental costs stays ready to go.

Given these patterns, we are pushing our 2% expansion figure back one quarter to Q4 2024. While we are keeping up with our require a slice to the Fed Subsidizes rate in June, more headway on expansion should be made among occasionally. Accepting this occurs, we expect four 25 bp cuts this year (100bps altogether) and an extra four 25 bp cuts in 2025 (100bps altogether).

How is the economy right now in the USA?

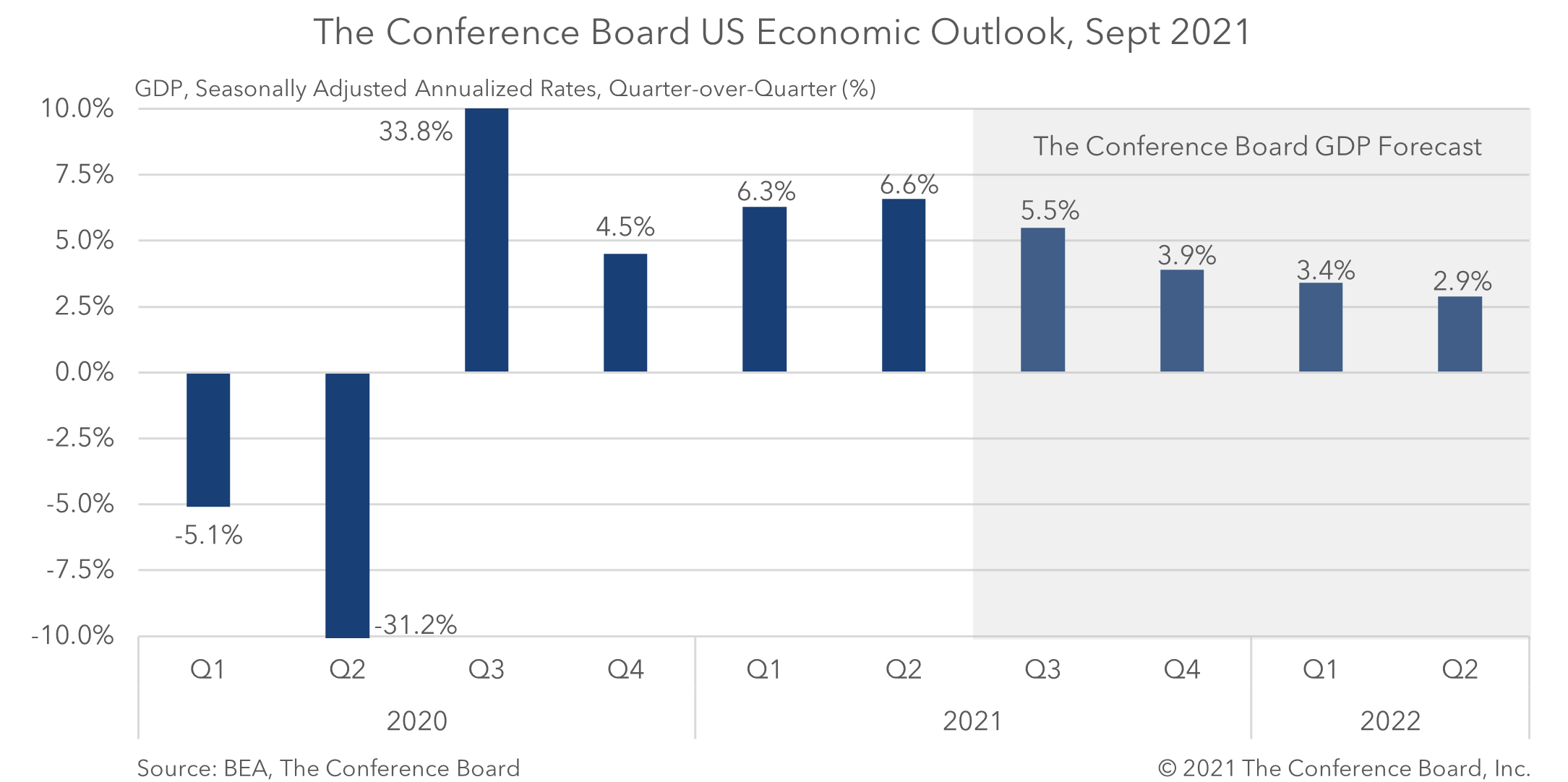

How is the US economy getting along? US GDP (Gross domestic product) expanded 1.9% in 2022 and another 2.5% in 2023. Year-over-year expansion — the rate at which buyer costs increment — was 3.1% in January 2023. The Central bank raised loan fees multiple times in 2022 and multiple times in 2023.

Will the US economy ever get better?

Generally speaking, notwithstanding a normal lull in the approaching quarters, we anticipate that the We economy should post genuine development of 2.4% this year and 1.4% in 2025. Over the whole figure, financial development midpoints 1.8% each year, marginally higher than the drawn out capability of 1.5% each year.

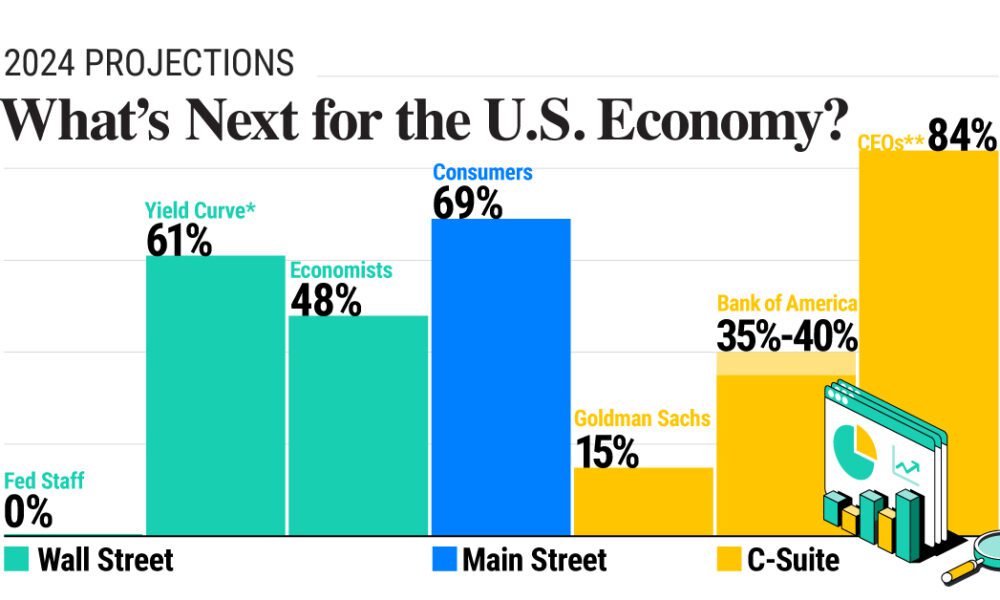

Is the USA going into a recession?

At a certain point in the fall of 2022, a model by Bloomberg extended a 100 percent hazard of a US downturn over the accompanying a year. Presently, numerous financial specialists are in the delicate landing camp as customer spending and the positions market have demonstrated to be substantially more versatile than expected.

Why is the US economy stronger than Europe?

All things considered, the U.S's. huge spending put Americans in a far more grounded position than their European partners. Even with expansion, spiking energy costs, and increasing loan fees, European purchasers had to scale back. However, Americans, reinforced by about $2.5 trillion in abundance reserve funds, recently continued to spend.