Indeed, even as the U.S. Central bank unexpectedly dropped plans for its yearly face to face meeting in Jackson Opening, Wyoming, because of rising Covid cases, Took care of Seat Jerome Powell has been resolute as he would see it that the delta variation represents no significant gamble to U.S.

Financial recuperation. During the now virtual occasion this end of the week, the Federal Reserve is supposed to declare rollbacks to monetary and strategy upholds gave during the pinnacle of the U.S. Coronavirus transmission, yet the inquiry actually remains: How might the U.S. economy recuperate from a notable pandemic?

For bits of knowledge, the Center point connected with Johns Hopkins financial specialist Jonathan Wright. A specialist in econometrics, exact macroeconomics, and observational money, Wright is likewise knowledgeable about monetary estimating and examination.

The long-term college teacher shared his contemplations about what the U.S. monetary recuperation could seem to be, why he'll watch, and which parts of the economy have previously recuperated and could try and be blasting.

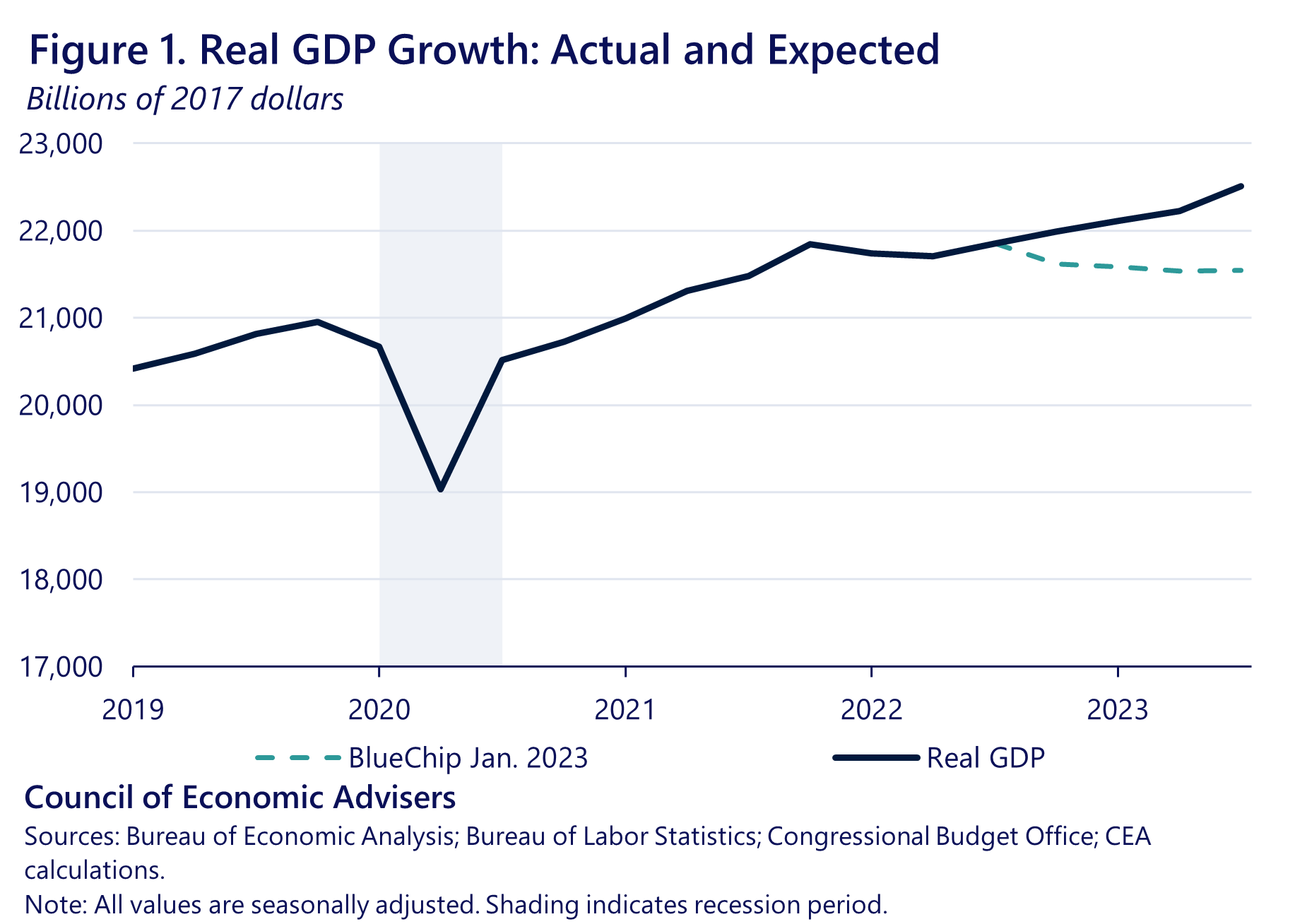

The degree of result (GDP), which for the subsequent quarter has returned to where it was in 2019, is still underneath what we'd maintain that it should be. Yield should develop after some time. Thus there has been a time of eighteen months where there was no net development, however more terrible than that, the degree of business is somewhere near 7 million individuals.

A ton of that is down to the workforce having contracted individuals aren't simply not working, they're likewise not effectively searching for a task. They might have resigned before, for instance. Individuals are as yet terrified of becoming ill, and that is driving them to avoid the workforce.

They have youngster care issues. Also, another thing I think has a place on the rundown (however I wouldn't put it at top) is that the degree of joblessness advantages may be deterring certain individuals from returning to work. The way that the degree of business is as yet 7 million underneath where it was — including many individuals of supposed prime age, the 25-to-54-year-old gathering that is as yet a major concern.

In this way, the resuming of the economy, maybe not excessively shockingly, has ended up being a sluggish and troublesome cycle, even with all the boost set up. The downturn finished in April 2020 as the economy has been developing from that point forward, yet the economy was in an extremely profound opening. The initial segment of the recuperation was quick, yet over the course of the past year or something like that, has continued all the more bit by bit.

Indeed, we are as yet confronting those too. There are sure areas with bottlenecks, semiconductors being one, and in spite of the fact that it's not unavoidable, there unquestionably are limitations which have impacted a few areas like the auto area. Global exchange has been impacted, so that would be something else that is a piece of restarting the economy that is running gradually.

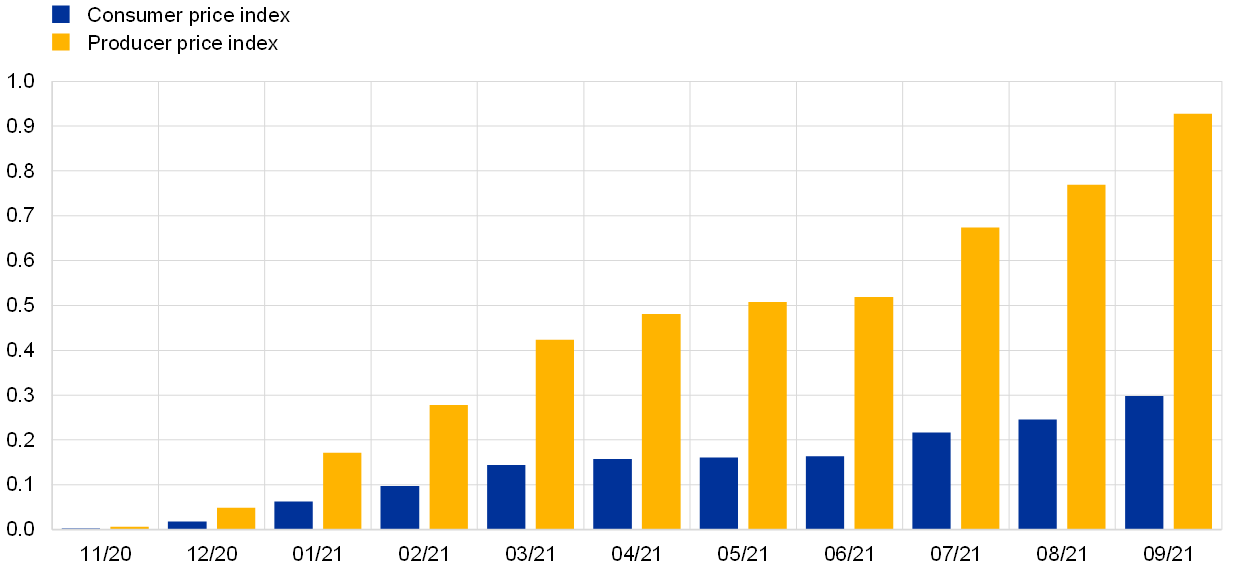

Store network imperatives are causing expansion in certain areas. Accordingly, the Federal Reserve's favored expansion measure is currently running at 3.5%, which is over the long-run target. Be that as it may, firms are adjusting to supply disturbances and will most likely form more vigorous stockpile chains from here on out.

One thing is money related approach, which is the degree of financing costs, and the Fed has given its best there. The degree of financing costs has been set to nothing. It's not pragmatic, in that frame of mind., to have rates under nothing. They have additionally purchased Depository protections and home loan supported protections to attempt to straightforwardly bring down longer-term financing costs. The Fed has actually given its best for put it in high gear.

The other thing is monetary arrangement, which incorporates crisis spending and upgraded joblessness benefits. This has helped an incredible arrangement. It empowered individuals to keep up with their spending when they in any case could never have had the option to. One individual's spending is someone else's pay, and not having joblessness protection is the very sort of thing that would have achieved a more unmanageable downturn.

So monetary strategy has done a great deal. Presently, the inquiry becomes, when does the monetary arrangement, which is helping interest, become excessively? Turns out to be to such an extent that it simply drives up costs in light of the fact that the useful limit of the economy has been reached? I don't believe we're there, yet I feel that is a genuine inquiry. Financial specialists discuss the result hole, which is the distinction between what the economy produces and what it is equipped for delivering.

I think there is as yet a result hole I think there are as yet unused assets. Yet, a discussion is suitable about how far financial boost can go before it produces expansion. Furthermore, by expansion, I'm not discussing transitory expansion to do with production network interruptions and something like that, yet a more persevering type of expansion.

One awful possible result of all that has been accomplished is that resource markets stock costs, costs of corporate securities, protections, lodging costs are presently exceptionally foamy and costly. I don't stress a lot over seeing shopper costs going up in an unreasonable manner. To the degree that that occurs, the Fed will possess the ability to ease back the economy and to manage expansion, and will very much want to do this than to stress over an economy stuck at zero loan fees.

However, I think there are stresses over resource costs, and somewhat that might be putting up issues not too far off. Not that it would have been suitable for financial approach to do any less due to those worries, yet resource costs are very raised. That is the concern that we ought to have toward the rear of our heads as the economy returns to wellbeing that the valuations of our monetary resources are at times extremely difficult to legitimize.