Is QBTS a Good Stock to Buy? Investors seeking to get in early on the next huge wave in era are turning their attention to D-Wave Quantum Inc. (NYSE: QBTS). As one of the few publicly traded groups targeted solely on quantum computing.

QBTS inventory has piqued hobby amongst increase traders, tech fanatics, and institutional players alike. But is Is QBTS a Good Stock to Buy for proper now? In this article, we’ll discover the employer's basics, growth ability, current overall performance, and associated risks to assist solution that question.

D-Wave Quantum Inc. Is a Canadian-based totally organization pioneering the improvement of quantum computing structures, software program, and services. Unlike maximum quantum startups centered on gate-based quantum computer systems, D-Wave makes a speciality of quantum annealing—a shape of computing that’s specially appropriate for fixing complicated optimization issues.

Read Also: What Happens if I Buy Tesla Stock Today 11th March 2025?

The enterprise went public via a SPAC merger in 2022 and trades underneath the ticker symbol QBTS on the NYSE.

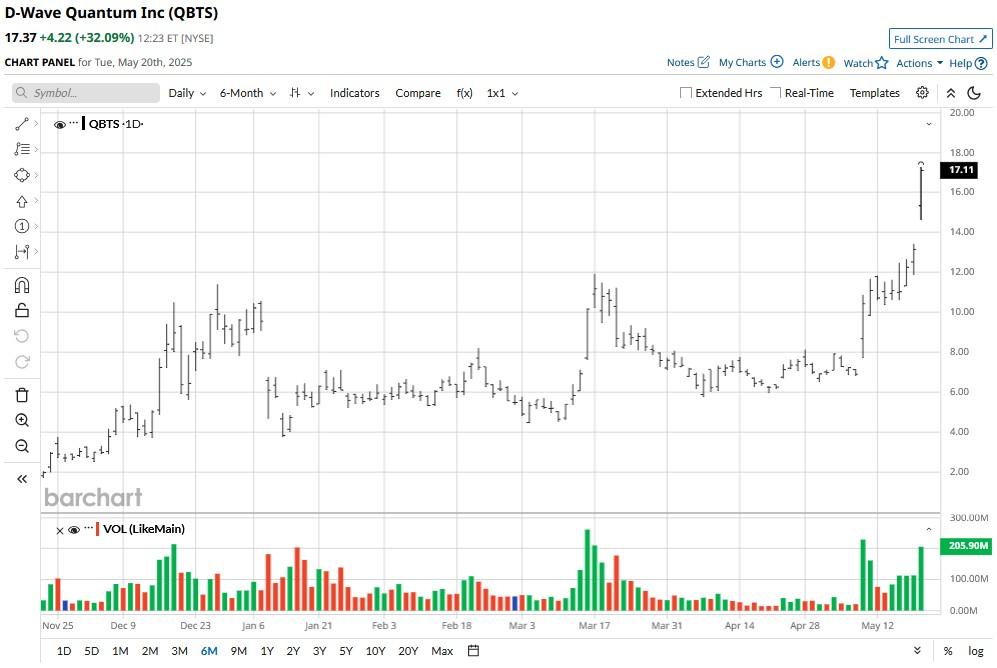

Like many early-stage tech companies, QBTS inventory has visible big volatility. After its public debut, the inventory experienced a sturdy surge driven via investor enthusiasm across the future of quantum computing. However, macroeconomic conditions, growing interest charges, and concerns over profitability have given that driven the stock into bearish territory.

As of mid-2025, QBTS stock forecast 2025 underneath $2 in step with proportion, reflecting careful investor sentiment—however also offering a low-value access factor for those with a high-chance tolerance.

D-Wave is one of the most effective groups supplying industrial quantum computing services through cloud-based structures. Its Leap™ quantum cloud carrier permits groups to experiment with real-world use instances ranging from logistics to system mastering. This gives D-Wave a primary-mover benefit in a zone this is nonetheless in its infancy.

The organisation has fashioned partnerships with fundamental companies like Lockheed Martin, Volkswagen, and NEC, which validates its era and enhances commercial viability. These collaborations intention to use D-Wave's quantum solutions to complicated industrial problems, boosting both credibility and ability revenue.

According to numerous industry forecasts, the global quantum computing marketplace is anticipated to reach over $10 billion via 2030, driven by way of advances in hardware, software, and increased agency adoption. D-Wave is properly-located to seize a slice of this expanding marketplace.

Revenue Growth: D-Wave stated year-over-yr revenue increase in 2024, with profits reflecting elevated hobby in quantum-as-a-carrier (QaaS) fashions. However, the agency continues to be now not profitable, that is traditional for deep-tech corporations at this level.

Related Article: What Role Does Competition Play in International Trade?

Cash Burn and Dilution Risks: A predominant challenge for buyers is D-Wave's coins burn charge. To maintain operations and R&D, the business enterprise may also rely upon extra investment, probably main to stock dilution. This threat is worth noting if you're considering a protracted-time period position.

Balance Sheet: The company’s balance sheet reveals confined cash reserves and modest debt, a blended signal for buyers. Although not overly leveraged, its reliance on capital markets for investment remains a crimson flag for conservative traders.

As of Q2 2025, analyst insurance on QBTS is constrained because of its small marketplace cap. However, folks who do cover it generally categorize the stock as a speculative purchase, citing strong technology however warning of monetary instability. Social media sentiment and retail investor discussions (e.G., on Reddit and StockTwits) continue to be mixed but show developing hobby amongst tech-forward buyers.

Reasons to Consider Buying QBTS:

Reasons to Be Cautious:

If you’re an investor with a high-threat tolerance seeking out exposure to frontier technologies, QBTS stock forecast 2025 can be a speculative guess really worth thinking about. However, it’s no longer appropriate for conservative investors or the ones searching out close to-term returns.

Pro Tip:

Investors must keep in mind dollar-cost averaging, allocating simplest a small percent in their portfolio to speculative selections like QBTS. Staying up to date on quarterly earnings and new purchaser wins also can help tell your selection over time. Is the Stock Market Open On Veterans Day?

So, is QBTS stock forecast 2025 a very good inventory to shop for? The solution depends largely for your funding goals. While the organisation gives exciting lengthy-term capacity within the quantum space, it comes with big financial and market dangers. For those willing to take a calculated chance in the early stages of a disruptive generation, QBTS might be a compelling (albeit volatile) possibility.

Why is QBTS inventory up?

D-Wave Stock Surges 28%. The Company Made an Advancement within the Quantum Race. Stated Tuesday that its sixth-era quantum machine had turn out to be to be had over the cloud, marking another development within the race to develop commercially feasible quantum computer systems.

Is Home Depot stock a buy, promote, or preserve?

Based on analyst scores, Home Depot's 12-month average rate target is 429.Seventy one. Home Depot has 12.Eighty five% upside ability, primarily based on the analysts' common rate target. Home Depot has a consensus rating of Moderate Buy that is based on 20 purchase rankings, 7 hold rankings and 1 promote scores.

Why paint shares are growing?

The Indian paint enterprise is growing steadily. Urbanisation, growing disposable earning, and housing call for are key drivers. People are also spending more on home improvement and interior layout. Festivals and wedding ceremony seasons in addition increase paint sales.

Is Home Depot undervalued or puffed up?

With its 2-megastar score, we trust Home Depot's inventory is overvalued as compared with our long-term fair price estimate of $305 in line with percentage. The agency published better-than-anticipated revenue, which grew 14% to $39.7 billion, and wonderful identical-shop sales growth of zero.Eight% for the primary time due to the fact 2022.

Is Home Depot an extended-term buy?

Home Depot (NYSE: HD) has been an tremendous stock for buyers who have bought and held for the long time. Although it's now not a growth inventory, it has outperformed the marketplace, and by means of a huge margin. Several factors make a contribution to its achievement, and it's a clear example of the "winners preserve on triumphing" funding method.